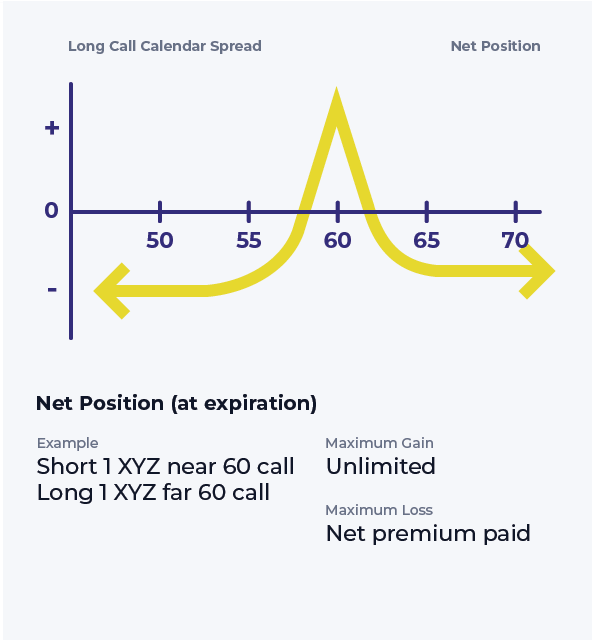

Long Call Calendar Spread

Long Call Calendar Spread - A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. This strategy involves buying a longer. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the.

Long Calendar Spreads for Beginner Options Traders projectfinance

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar spread is a good strategy to use when you expect the. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price,.

Long Calendar Spread with Calls Strategy With Example

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Calendar spreads are a great way to combine the advantages of spreads and directional options trades.

The Long Calendar Spread Explained 1 Options Trading Software

Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. A long calendar spread is a good strategy to use when you expect the. This strategy.

Long Calendar Spreads Unofficed

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. A long calendar call spread is seasoned option strategy where you sell and buy same strike price.

Long Call Calendar Spread Strategy Nesta Adelaide

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Learn how to create and manage a long calendar spread with calls, a strategy that profits.

Long Calendar Spread with Calls

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to use when you expect the. Learn.

Long Call Calendar Spread Explained (Options Trading Strategies For

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. This strategy involves buying a longer. Learn how to use a long call calendar spread.

Investors Education Long Call Calendar Spread Webull

This strategy involves buying a longer. A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is seasoned option strategy where you sell and buy same.

How to Trade Options Calendar Spreads (Visuals and Examples)

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar call spread is seasoned option strategy where you sell and buy same.

Long Call Calendar Spread Options Strategy

A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. Learn how to use a long call calendar spread to combine a bullish and a.

A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at. This strategy involves buying a longer.

Calendar Spreads Are A Great Way To Combine The Advantages Of Spreads And Directional Options Trades In The Same Position.

Learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the. This strategy involves buying a longer. A long calendar spread is a good strategy to use when you expect the. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock.

A Long Calendar Call Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Calls With The Purchased Call Expiring One.

A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at.