Short Put Calendar Spread

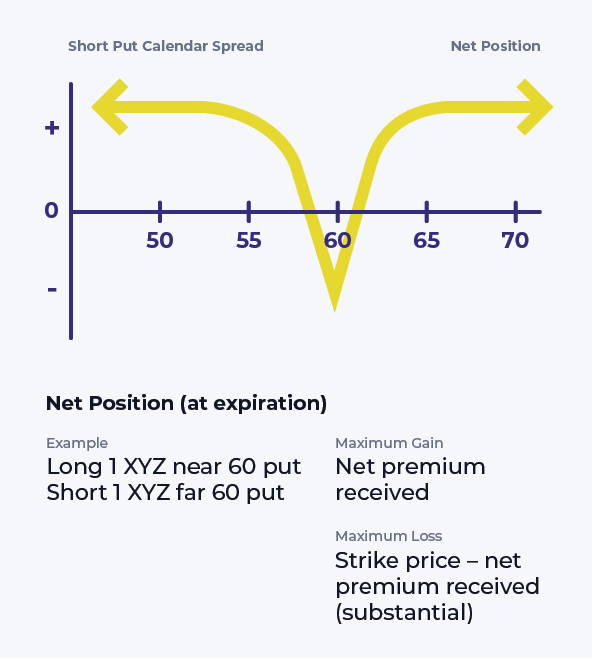

Short Put Calendar Spread - A short put calendar spread is another type of spread that uses two different put options. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. The strategy most commonly involves puts with the same. You sell a put with a further out expiration and buy a put with a closer expiration date. The typical calendar spread trade. With a short put calendar spread, the two options have the same strike price but different expiration dates. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Selling an option contract you don’t yet own creates a “short” position. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Put Calendar Spread Option Samurai Blog

The strategy most commonly involves puts with the same. You sell a put with a further out expiration and buy a put with a closer expiration date. Selling an option contract you don’t yet own creates a “short” position. A short put calendar spread is another type of spread that uses two different put options. When running a calendar spread.

Short Put Calendar Spread Printable Calendars AT A GLANCE

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. A short put calendar spread is another type of spread that uses two different put options. You sell a put with a further out expiration and.

Short Put Calendar Spread Options Strategy

The typical calendar spread trade. The strategy most commonly involves puts with the same. With a short put calendar spread, the two options have the same strike price but different expiration dates. You sell a put with a further out expiration and buy a put with a closer expiration date. Selling an option contract you don’t yet own creates a.

Short Calendar Put Spread Staci Elladine

The typical calendar spread trade. A short put calendar spread is another type of spread that uses two different put options. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Selling an option contract you don’t yet own creates a “short” position. To profit from.

Advanced options strategies (Level 3) Robinhood

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. The strategy most commonly involves puts with the same. The typical calendar spread trade. You sell a put with a further out expiration and buy a.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

You sell a put with a further out expiration and buy a put with a closer expiration date. The typical calendar spread trade. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Selling an option contract you don’t yet own creates.

Short Put Calendar Spread

You sell a put with a further out expiration and buy a put with a closer expiration date. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Buying one put option and selling a second put option with a more distant expiration is an example.

Calendar Put Spread Options Edge

With a short put calendar spread, the two options have the same strike price but different expiration dates. The typical calendar spread trade. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. When running a calendar spread with calls, you’re selling and buying a call.

Options Trading Made Easy Ratio Put Calendar Spread

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Selling an option contract you don’t yet own creates a “short” position..

Short Put Calendar Short put calendar Spread Reverse Calendar

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. You sell a put with a further out expiration and buy a put with a closer expiration date. The typical calendar spread trade. Buying one put.

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. The typical calendar spread trade. With a short put calendar spread, the two options have the same strike price but different expiration dates. Selling an option contract you don’t yet own creates a “short” position. You sell a put with a further out expiration and buy a put with a closer expiration date. The strategy most commonly involves puts with the same. A short put calendar spread is another type of spread that uses two different put options. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

To Profit From A Large Stock Price Move Away From The Strike Price Of The Calendar Spread With Limited Risk If There Is Little Or No Price Change.

The strategy most commonly involves puts with the same. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. With a short put calendar spread, the two options have the same strike price but different expiration dates. You sell a put with a further out expiration and buy a put with a closer expiration date.

The Typical Calendar Spread Trade.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. A short put calendar spread is another type of spread that uses two different put options. Selling an option contract you don’t yet own creates a “short” position.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)