What Is Calendar Spread - A calendar spread is a trading technique that involves the buying of a derivative of an asset in. Web what is a calendar spread? Web what is a calendar spread? A calendar spread is an options trading strategy that involves buying and selling. Web a calendar spread is an options strategy that involves multiple legs. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and. A calendar spread typically involves buying and selling the same type of option (calls or puts) for. It involves buying and selling contracts at the same strike price. Web what is a calendar spread?

What are Calendar Spread and Double Calendar Spread Strategies Espresso Bootcamp

A calendar spread typically involves buying and selling the same type of option (calls or puts) for. Web what is a calendar spread? Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on. A calendar spread is a trading technique that involves the buying of a derivative of an asset in..

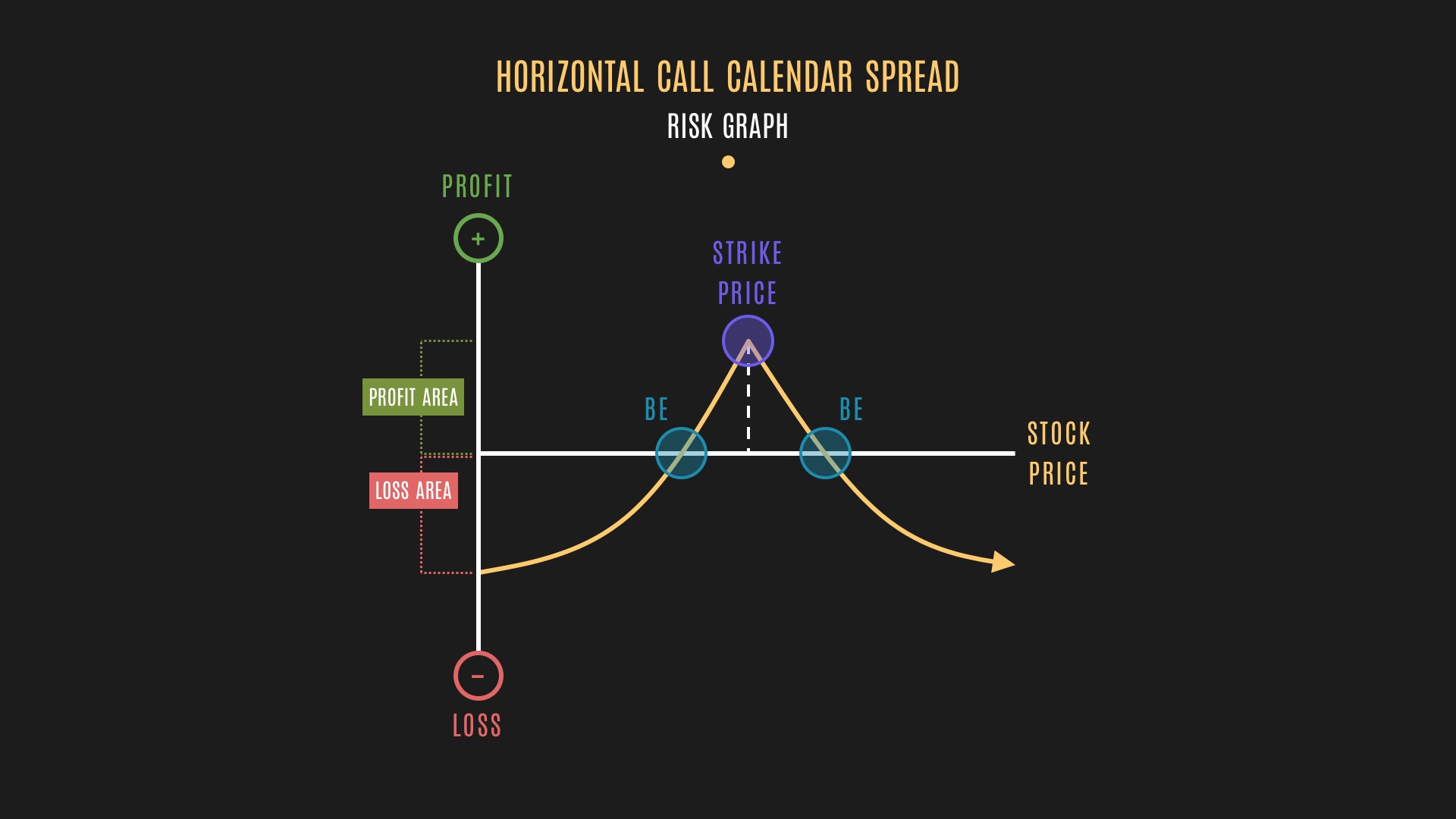

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

A calendar spread typically involves buying and selling the same type of option (calls or puts) for. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on. A calendar spread is an.

How Long Calendar Spreads Work (w/ Examples) Options Trading Explained YouTube

Web what is a calendar spread? A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and. Web what is a calendar spread? A calendar spread is a trading technique that involves the buying of a derivative of an asset in. Web a calendar spread is a sophisticated options or futures strategy.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A calendar spread is a trading technique that involves the buying of a derivative of an asset in. Web what is a calendar spread? A calendar spread is an options trading strategy that involves buying and selling. Web what is a calendar spread? Web a calendar spread is an options strategy that involves multiple legs.

Calendar Spread Options Trading Strategy In Python

Web what is a calendar spread? Web what is a calendar spread? A calendar spread typically involves buying and selling the same type of option (calls or puts) for. A calendar spread is an options trading strategy that involves buying and selling. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time.

Calendar Spread Explained InvestingFuse

Web what is a calendar spread? Web what is a calendar spread? A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and. A calendar spread typically involves buying and selling the same type of option (calls or puts) for. A calendar spread is a trading technique that involves the buying of.

How Calendar Spreads Work (Best Explanation) projectoption

Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on. Web what is a calendar spread? It involves buying and selling contracts at the same strike price. Web a calendar spread is an options strategy that involves multiple legs. A calendar spread is an options trading strategy that involves buying and.

How To Trade Calendar Spreads The Complete Guide

Web what is a calendar spread? It involves buying and selling contracts at the same strike price. A calendar spread is a trading technique that involves the buying of a derivative of an asset in. A calendar spread typically involves buying and selling the same type of option (calls or puts) for. A calendar spread is an options trading strategy.

How to Trade Options Calendar Spreads (Visuals and Examples)

A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and. A calendar spread typically involves buying and selling the same type of option (calls or puts) for. A calendar spread is a trading technique that involves the buying of a derivative of an asset in. A calendar spread is an options.

Pair Trading Strategy Spread Trading Strategy Calendar Spread Options IFCM

A calendar spread typically involves buying and selling the same type of option (calls or puts) for. Web what is a calendar spread? It involves buying and selling contracts at the same strike price. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and. Web what is a calendar spread?

Web what is a calendar spread? A calendar spread typically involves buying and selling the same type of option (calls or puts) for. A calendar spread is an options trading strategy that involves buying and selling. Web a calendar spread is an options strategy that involves multiple legs. It involves buying and selling contracts at the same strike price. Web what is a calendar spread? Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on. A calendar spread is a trading technique that involves the buying of a derivative of an asset in. Web what is a calendar spread? A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and.

Web What Is A Calendar Spread?

It involves buying and selling contracts at the same strike price. A calendar spread is an options trading strategy that involves buying and selling. Web what is a calendar spread? Web a calendar spread is an options strategy that involves multiple legs.

A Calendar Spread Typically Involves Buying And Selling The Same Type Of Option (Calls Or Puts) For.

Web what is a calendar spread? A calendar spread is a trading technique that involves the buying of a derivative of an asset in. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)